Impact Investing

Our philosophy on financial return

We profit when we invest in people and the planet.

AJL Foundation believes our mission applies across our portfolio - not just to our grantmaking - and we hold positive social impact and financial return as equally-weighted objectives within our portfolio.

Mission

To invest in the people, programs and movements that benefit Colorado's youth and families.

Impact Objective

To avoid harm, benefit affected communities and contribute to solutions wherever possible.

Financial Objective

CPI + 5% per year

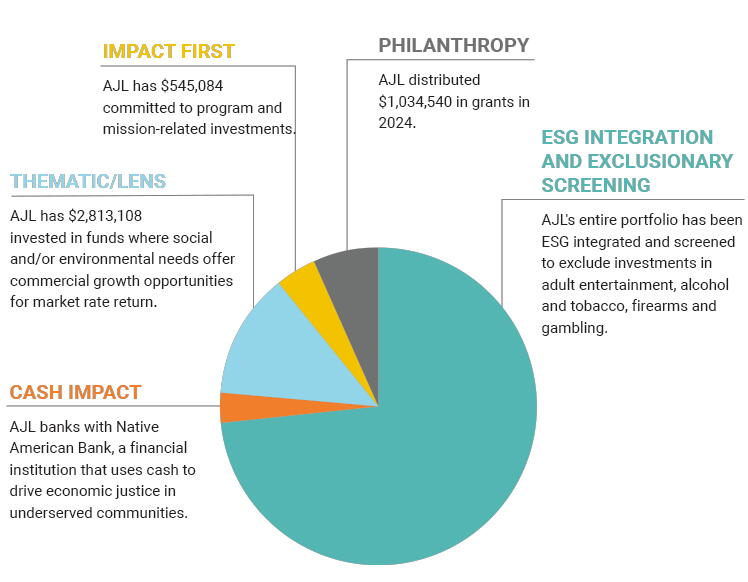

Our Portfolio (as of 12/31/2024)

$15,835,476

AJL was funded in 2011 with $10,845,128 and has distributed $8,338,099 in grants since inception.

Transparency

AJL Foundation is committed to transparency by publishing both financial and impact performance quarterly on our website for two reasons: 1) to show the communities we serve that we are using every dollar we have control over for positive social and environmental impact and 2) to contribute our learnings to the field. AJL's quarterly reports can be reviewed on the blog and accessed by year below:

For our impact investing timeline and resources, click here: Impact Investing: AJL's Journey, Timeline and Resources

ESG Integration

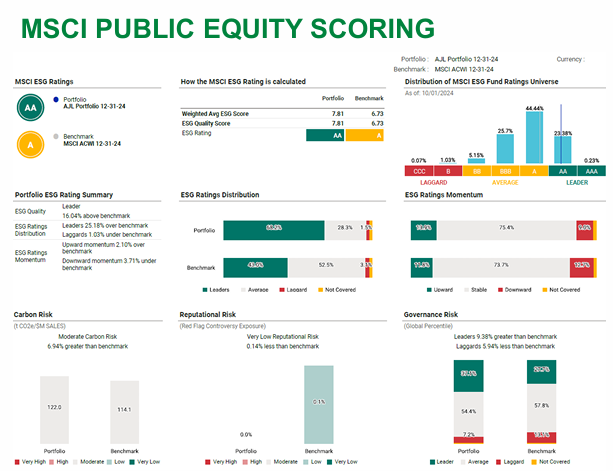

ESG (environmental, social and governance) Investing is a term that is often used synonymously with sustainable investing, socially responsible investing, mission-related investing, or screening. It's the consideration of environmental, social and governance factors alongside financial factors in the investment decision-making process which can help identify material risks and growth opportunities. ESG metrics are not commonly part of mandatory financial reporting, though companies are increasingly making disclosures in their annual report or in a standalone sustainability report. AJL has integrated ESG criteria across our entire portfolio and the snapshot shows how AJL's portfolio stacks up when evaluated based on ESG factors (as of 12/31/2024).

Thematic/Lens Investing

Thematic/Lens investing focuses on issue areas where social and/or environmental needs offer commercial growth opportunities for market rate return. AJL is investing to support the United Nations Sustainable Development Goals #10 "Reduced Inequalities" and #11 "Sustainable Cities and Communities." As of 12/31/2024, to support this commitment, 18% of AJL’s portfolio was invested in Pax World Global Green Fund, CCM Community Impact Bond Fund, Adasina Social Capital, Variant Impact Fund, Lafayette Square and CoInvest.

Impact First

Impact First investments emphasize the optimization of social and/or environmental needs (ie: PRIs) which may result in financial tradeoff. As of 12/31/2024, $545,084 (or 3%) of AJL’s portfolio is committed to six PRIs. Visit this page to learn more about AJL’s current direct investments.

Philanthropy

Philanthropic investments are grants where social needs outweigh any consideration for financial return. in 2024, AJL distributed $1,034,540 as non-recoverable grants to nonprofit organizations that serve families and youth in education, human services and healthcare. Visit this page to learn more about AJL's grantmaking process.

Exclusionary Screening

Exclusionary screening involves filtering out companies based on revenue derived from a specific activity. AJL’s entire portfolio has been screened to exclude investments in adult entertainment, alcohol and tobacco, firearms and gambling.

Cash Impact

AJL banks with Native American Bank, an institution that uses the cash to drive economic justice in underserved communities. Visit this page to learn more about these investments.

Diversity and Finance

AJL’s core values include diversity and inclusion and it is our intention to invest alongside those values. The Knight Foundation’s 2018 Diverse Asset Management Firm Assessment identified that within asset management women and minorities are dramatically underrepresented. AJL has made it a priority to include in its evaluation criteria of investment managers the diversity of the investment team and/or management not only because it makes financial sense (diverse teams add value) but also to drive change within the investment industry. As of 12/31/24, over half (75%) of the investment manager’s portfolio management teams have gender and/or racial diversity.

Additional Strategies for Impact

Shareholder

Advocacy

AJL is using its equity stake in companies to influence the companies’ management and policies through proxy voting and resolutions. AJL’s investment managers expect the companies they invest in to adhere to effective governance practices and consider their impact on the environment and communities.

New Product Investments

AJL is exploring investing in and creating new impact investments across the risk/return spectrum to expand the number and range of impact investments in the capital markets. Those investments are both in the public and private markets.

Capacity Building Support

AJL is utilizing a blended capital strategy to build capacity for early stage enterprises and incubate investment models to support diverse entrepreneurs. A blended capital strategy uses grants to provide the intermediary with the support so it can provide higher risk, higher transaction costs capital without passing all the costs to the end user.

Investment Manager Engagement

AJL, in partnership with its investment advisor, is engaging with investment managers to be more transparent about diversity and inclusion within the firm, ESG practices, and alignment with the Sustainable Development Goals.

Keep in Mind...

AJL’s objective is to design an impact/mission aligned portfolio that maximizes both return and impact. Over the last year, even though the Foundation is 100% impact aligned, there have been some areas that are not perfect, outlined below:

- There are limited impact funds in specific asset classes.

- Exclusionary Screens can remove the direct exposure to specific companies which derive revenue from the screened sectors but that doesn’t always remove the business involvement in those sectors by other companies in the portfolio.

- Currently, there isn’t a standardized framework for measuring ESG data, so the ratings for companies can vary widely between ESG ratings agencies.

- The measurement, evaluation and data are limited for understanding impact and how to integrate it into the decision-making process that considers risk, return, and impact.

While the aforementioned limitations can appear to be challenges these are actually opportunities for foundations, beneficiaries, and investors to work together to be field builders and develop tools to drive more capital towards impact.

Additional resources:

- AJL Foundation's Investment Policy Statement

- AJL Foundation's Expression of Interest for Impact-Oriented Investment Advisor (September 2018)

- AJL Foundation's Request for Proposal for Impact-Oriented Investment Advisor (December 2018)

- Philanthropy Colorado's Request for Proposal for Socially-Conscious Bank (August 2021)

- Impact Investing Journey: How We Got Started (part 1) - Blog Post

- Impact Investing Journey: How We Evaluated Our Financial Advisors (part 2) - Blog Post

- Impact Investing Journey: How We Invest For Impact (part 4) - Blog Post

- Impact Investing Journey: Timeline and Resources (part 5) - Blog Post

- Impact Investing: Strategies and Evaluation of Impact Alignment Across Our Portfolio - Video (July 2022)

- 2024 Report: Summary of Key Insights – Endowment Impact Benchmark - Cohort Report (February 2025)

If you have any questions or would like additional detail regarding our investment strategies and performance, please don't hesitate to reach out to Kristi Petrie at kpetrie@ajlfoundation.org.